The stock market and crypto market have been on fire over the last few weeks. The NASDAQ was up about 6.5%, meanwhile, Bitcoin is up a massive 38.12% over the last month. You might be brand new to the world of investing and looking to get in on the action.

Personal Experience and Goals for the article investing apps

Over the past some days, I’ve spent thousands of hours testing and reviewing different investing apps for my blog, flytrad.com. So in this article, we’re going to be breaking down the best investing apps, and I’m going to be explaining to you why I think these are the best choices based on my experience.

We have already written an article on investing apps, you can also check it out if you want.

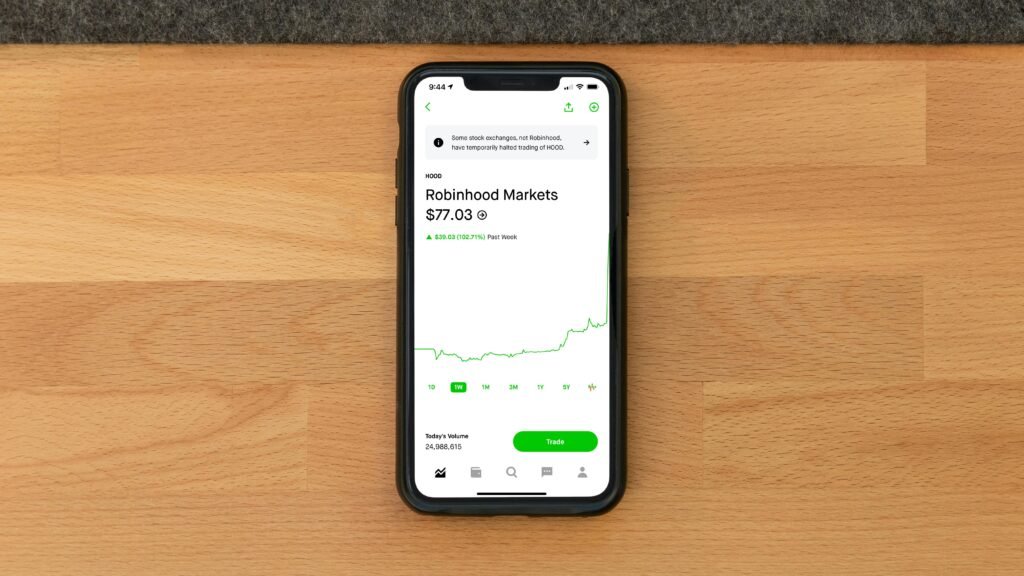

1. Robinhood: The Pioneer of Commission-Free Trading

Robinhood is the fintech company that kicked off the commission-free stock trading revolution. it started out as the newcomer on the block looking to shake things up in the world of traditional finance.

Key Features of Robinhood

- Commission-Free Trading: Robinhood supports fractional investing in over 10,000 securities like stocks and ETFs listed on major US exchanges.

- Fractional Investing: You can invest in dollar increments instead of whole shares, starting as low as $1.

- Diverse Asset Support: In addition to stocks, Robinhood offers options, futures, and crypto trading.

Recent Updates

Robinhood launched a new advanced desktop trading platform called Robinhood Legend, designed for active traders seeking a robust experience.

Retirement Accounts

Robinhood users can open traditional or Roth IRAs with a unique match feature:

- 1% Match: For basic accounts.

- 3% Match: For Robinhood Gold users.

2. Coinbase: The Largest U.S. Crypto Exchange

Coinbase is the largest crypto exchange in the United States and currently sees a massive inflow of new users.

Features of Coinbase

- Ease of Use: Ideal for beginners entering the crypto world.

- Token Availability: Trade over 150 different tokens.

- Additional Tools: Offers Coinbase Earn and Coinbase Learn to maximize user benefits.

Promotions

Coinbase offers a $50 Bitcoin bonus for new accounts that complete their first trade within 48 hours.

3. M1 Finance: High-Yield Cash Management

For managing uninvested cash, M1 Finance offers a high-yield cash account with competitive APY rates, currently at 4.25%.

Pros and Cons

- FDIC Insured: Money is secure and earns monthly interest.

- Fee for Small Accounts: Balances under $10,000 incur fees.

4. Crypto.com: Advanced Crypto Features

Crypto.com offers a robust platform with advanced trading features.

Key Features

- Diverse Tokens: Over 200 different cryptocurrencies.

- Crypto Visa Card: Spend crypto balances as USD instantly.

Warning

Crypto investing is inherently risky, especially with advanced strategies like derivatives.

5. Public: Investing and Research Combined

Public combines investment options with research tools, offering a unique platform.

Features

- Equities and Bonds: Includes direct bond ownership.

- Alternative Assets: Invest in art, collectibles, and more.

- AI Research Tools: Cutting-edge features for investors.

6. WeBull: A Robust Trading Platform

WeBull is known for offering advanced charting and data, making it popular among active traders.

Unique Offerings

- WeBull Light: A beginner-friendly interface.

- Promotions: Free stock bonuses ranging from $3 to $3,000.

7. Fidelity: A Trusted Legacy

Fidelity, established in 1946, offers a comprehensive financial platform for traditional investing.

Benefits

- Zero-Fee Funds: Fidelity Zero Index Mutual Funds with no expenses.

- Broad Asset Availability: Stocks, ETFs, mutual funds, and more.

Limitations

Unlike newer apps, Fidelity does not offer sign-up bonuses but focuses on robust service.

Conclusion

Investing has by no means been more handy, thanks to plenty of apps tailor-made to special wishes and enjoy tiers. Whether you’re just starting out or trying to refine your portfolio, these structures provide particular functions to match numerous investment strategies.

From Robinhood’s fee-loose trading revolution to Coinbase’s novice-pleasant crypto platform, and Fidelity’s long-status reputation for comprehensive monetary services, there is an app for every form of investor.

Consider your financial goals, risk tolerance, and preferred assets when choosing the right platform. With the tools and resources available today, anyone can start their investing apps journey confidently. Happy investing!

FAQ:

Q1: Why are inventory and crypto markets presently gaining attention?

The stock marketplace, such as the NASDAQ, has visible significant profits, while Bitcoin has risen over 38% in the final month. These trends have drawn new and seasoned investors trying to capitalize at the growth.

Q2: What are the first-class apps for novices in investing?

For beginners, apps like Robinhood and Coinbase are terrific selections. Robinhood gives commission-loose buying and selling and fractional investing, while Coinbase is consumer-friendly for crypto investments.

Q3: Are there apps that combine traditional and alternative investments?

Yes, platforms like Public allow users to invest in stocks, bonds, and alternative assets like art and collectibles, making it a versatile option.

Q4: Which app is best for active traders?

WeBull is highly favored by active traders for its advanced charting tools and data analysis features. It also provides free stock bonuses for new users.

Q5: Can I earn interest on uninvested cash through any of these apps?

M1 Finance offers a high-yield cash account with a competitive APY of 4.25%, making it an excellent choice for earning interest on uninvested funds.