Fidelity Investments is one of the most relied on brokerage firms, supplying various services for traders in view that 1948. Whether or not you’re new to investing or a seasoned pro, know-how the way to use constancy effectively let you maximize your monetary dreams.

Step 1: setting up Your constancy Account

Earlier than diving into investments, you want to set up an account. Fidelity gives numerous options, including:

- Retirement accounts like Roth IRAs.

- Traditional brokerage bills.

- Crypto savings.

- Accounts for youngsters’s education.

- Self-employment making an investment.

To get commenced, go to constancy’s website or app and select the account type that aligns along with your goals. For example,

A Roth IRA is splendid for tax-advantaged retirement savings. Follow the stairs to enter your personal info, which include your full criminal call, Social security variety, and driving force’s license. The system typically takes about 10 mins, and your account might be activated right away.

Step 2: investment Your constancy Account

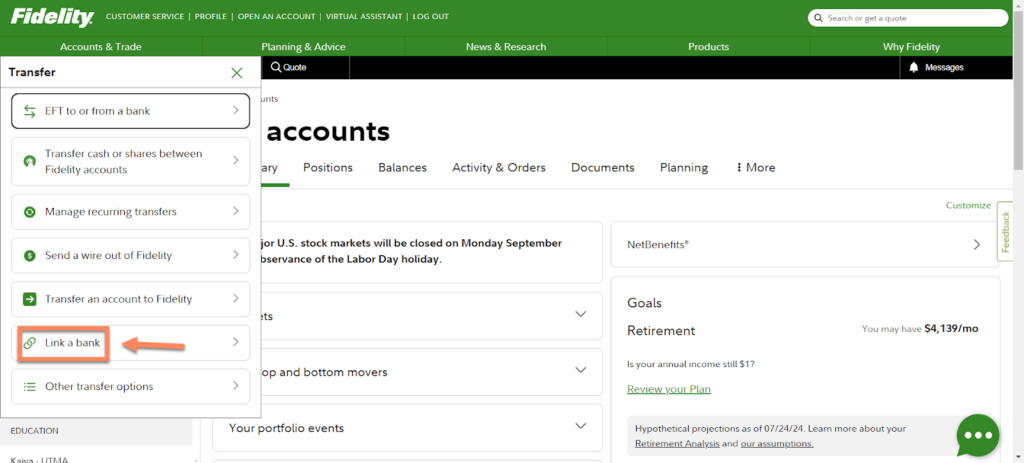

Once your account is lively, you can fund it via the app or internet site:

- Select “Add Funds” or “Transfer” out of your dashboard.

- Link your financial institution account by using getting into your details and finishing the authentication process.

- Pick out the quantity you want to switch.

Finances typically settle inside 1–three enterprise days. Once the switch is entire, you’re prepared to begin investing.

Step 3: Exploring investment options

Constancy offers a huge array of investment possibilities. Here are some highlights:

Fidelity Robo-Advisors

- Fidelity Go: best for beginners with much less than $25,000. No fees beneath this threshold, and also you get personalised funding strategies.

- Fidelity managed Portfolios: requires a $5,000 minimum funding. Gives tax-saving benefits and allows you to customize strategies.

DIY investing

Opt for managing your portfolio? Use constancy’s studies equipment to identify ability investments. For example,

The screener device permits you to clear out mutual price range, ETFs, and shares primarily based on criteria like danger tolerance and returns.

Step 4: choosing the proper fidelity finances

Fidelity’s in-house finances are a number of the quality alternatives for lengthy-time period increase. Popular picks consist of:

- Constancy 500 Index Fund (FXAIX): Tracks the S&P 500.

- Fidelity Total stock marketplace Index Fund (FSKAX): gives exposure to small, mid, and large-cap stocks.

- Fidelity US Bond Index Fund (FXNAX): gives solid earnings through bonds.

- Fidelity Total international Index Fund (FTIHX): For global diversification.

ETFs vs. Mutual funds

For tax efficiency, remember ETFs for taxable accounts. Mutual finances, like fidelity’s index options, paintings well in retirement debts like Roth IRAs.

Step 5: Automating Your Investments

Keep time via putting in place ordinary transfers and automatic investments:

- Visit “accounts & trade” > “Transfers” > “Recurring Transfers.”

- Agenda monthly investments into your chosen funds.

This guarantees consistency and builds your portfolio steadily over time.

Step 6: Leveraging fidelity’s research tools

Fidelity’s platform affords a wealth of assets to guide your investment selections:

- Mutual Fund Screener: clear out price range primarily based on standards like Morningstar rankings and price ratios.

- Stock & ETF Screeners: find out securities tailored on your financial desires.

- Planning tools: Set goals for retirement, home buying, or schooling and receive tailor-made strategies.

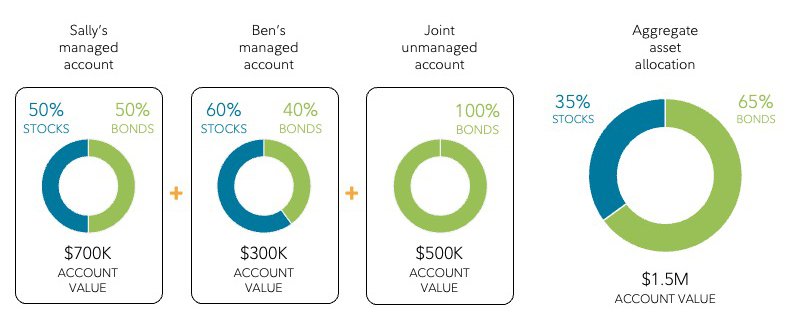

Step 7: handling Your Portfolio

Fidelity makes it smooth to control your portfolio and reinvest dividends:

- Use the “manipulate Dividends” characteristic to direct payouts into your favorite finances.

- Music your desires using constancy’s financial well being equipment.

- Set signals to live knowledgeable about marketplace adjustments.

Final Thoughts on Using Fidelity

Investing via fidelity may be a sport-changer for constructing long-term wealth. Right here’s a quick recap:

- Pick the proper account type to your dreams.

- Leverage research tools for clever investment selections.

- Automate your contributions for consistency.

- Stay disciplined and display your development.

With constancy’s user-friendly platform and robust tools, you may hopefully take charge of your economic future.

FAQs about the usage of fidelity Investments

- What styles of money owed does fidelity offer?

Fidelity affords a diffusion of account options, including Roth IRAs, conventional brokerage debts, crypto savings, training financial savings debts, and self-employment retirement plans.

- How do I fund my fidelity account?

You may fund your account with the aid of choosing “add finances” or “transfer” from your dashboard. Link a financial institution account, pick the quantity to switch, and price range will typically settle inside 1–three enterprise days.

- What funding options are available through constancy?

Fidelity gives a huge range of investment opportunities, inclusive of mutual funds, ETFs, shares, bonds, and managed portfolios. It additionally affords robo-advisors like constancy pass and fidelity managed Portfolios for computerized investment strategies.

- Am i able to automate my investments on fidelity?

Yes, you may set up routine transfers and automatic investments via the “Transfers” section of your account. This helps ensure regular contributions on your portfolio.

- What tools does fidelity offer to help control investments?

Fidelity gives studies equipment inclusive of mutual fund and stock screeners, financial making plans assets, and purpose-placing equipment for retirement, training, or most important purchases. Those assist you’re making informed decisions and song your development.