The stock market offers a dynamic avenue for wealth creation, attracting investors worldwide with the promise of financial growth. However, navigating this realm requires more than luck; it demands knowledge, strategy, and discipline. Understanding market trends, analyzing company performance, and mastering risk management are pivotal to success.

Whether you’re a novice or an experienced trader, the key lies in making informed decisions and staying patient. This guide explores proven strategies and tips to help you tap into the potential of the stock market.

What is the Stock Market?

A series of exchanges and over the counter markets, which offer troubles, buy, and promoting factors for the stocks of a publicly held organization, is known as the stock market. It serves as a marketplace for consumers and investors thru which they trade shares, bonds, and extraordinary financial securities.

Stocks: Represent possession in a enterprise organization, granting shareholders rights to a part of the corporation’s income and belongings.

Stock Exchange: A bodily or digital venue wherein stock buying and selling takes location, which includes the New York Stock Exchange (NYSE) or NASDAQ.

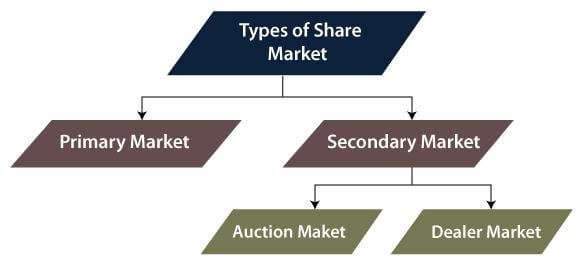

Types of Stock Markets

1. Primary Market

The number one market is in which groups problem new securities to raise capital. This is generally completed via Initial Public Offerings (IPOs).

IPO Process: A company offers shares to the general public for the first time. Purpose: Raising funds for expansion, debt compensation, or operational desires.

2. Secondary Market

The secondary market is in which formerly issued securities are traded among traders. Examples consist of the NYSE and the London Stock Exchange.

Key Features: Liquidity, charge discovery, and accessibility. Participants: Retail investors, institutional investors, and traders.

How Does the Stock Market Work?

- Listing Process: Companies examine to be indexed on a inventory exchange, meeting stringent standards.

- Buyers and Sellers: Trades occur among traders through brokers.

- Order Matching: Modern inventory markets make use of digital trading systems to healthy purchase and sell orders.

- Price Fluctuations: Determined through deliver and demand, influenced by way of earnings reviews, monetary facts, and investor sentiment.

Key Players within the Stock Market

- Investors: Individuals or entities who purchase shares to obtain long-term monetary goals.

- Traders: Focus on brief-term gains through common shopping for and selling.

- Market Makers: Facilitate liquidity by way of quoting buy and promote fees.

- Regulators: Ensure transparency and fairness, e.g., the Securities and Exchange Commission (SEC) in the U.S.

Benefits of the Stock Market

- Wealth Creation: Enables people to develop their wealth over the years via dividends and capital gains.

- Economic Growth: Provides companies with the capital wished for enlargement.

- Liquidity: Investors can quick convert stocks into cash.

- Diverse Opportunities: A wide range of investment alternatives, which include tech, healthcare, and renewable power sectors.

Risks Involved

- Market Volatility: Prices can fluctuate significantly.

- Economic Downturns: Recessions can lead to substantial losses.

- Fraud: Potential for scams or insider trading.

- Over-leverage: Using borrowed funds can amplify losses.

Tips for Stock Market Investment

- Research Thoroughly: Understand the agency’s fundamentals, industry developments, and economic outlook.

- Diversify: Spread investments throughout sectors to mitigate dangers.

- Stay Informed: Monitor market news and updates.

- Long-term Perspective: Focus on consistent increase instead of brief-time period gains.

- Set Goals: Define your financial targets and risk tolerance.

Conclusion

The stock market is a powerful tool for wealth creation, offering opportunities for growth through informed investing. While risks exist, they can be managed with research, diversification, and a disciplined approach. By understanding market dynamics and adopting a long-term perspective, investors can unlock the potential of the stock market to achieve financial success.

FAQs

What is the stock market?

The stock market is a group of exchanges and over the counter markets where stocks of publicly held organizations are sold and bought. It enables buying and selling in stocks, bonds, and other financial securities.

What are stocks?

Stocks constitute ownership in a corporation, giving shareholders rights to a portion of the corporation’s earnings and assets.

What is a stock exchange?

A stock alternate is a bodily or electronic platform wherein stock buying and selling takes place, such as the New York Stock Exchange (NYSE) or NASDAQ.

What are the types of stock markets?

Primary Market: Where groups difficulty new securities to raise capital thru Initial Public Offerings (IPOs). Secondary Market: Where formerly issued securities are traded among buyers, which includes the NYSE and London Stock Exchange.

How does the stock market work?

Companies list their shares on inventory exchanges. Buyers and sellers alternate stocks thru agents. Prices range based totally on supply, demand, and various market factors.

Who are the key players in the stock market?

- Investors: Buy shares for long-time period increase.

- Traders: Focus on short-term profits.

- Market Makers: Ensure liquidity through quoting purchase and sell costs.

- Regulators: Oversee market equity and transparency (e.G., SEC inside the U.S.).