As a beginner, understanding the basics of Bitsgap is crucial for making money and avoiding unnecessary losses along the way. This tutorial is your fast track to achieving exactly that.

Selecting a Plan

When it comes to selecting a plan, I highly encourage and recommend starting with the Advanced Plan. The reason for this is the inclusion of the trailing up feature, which is important for maximizing your returns.

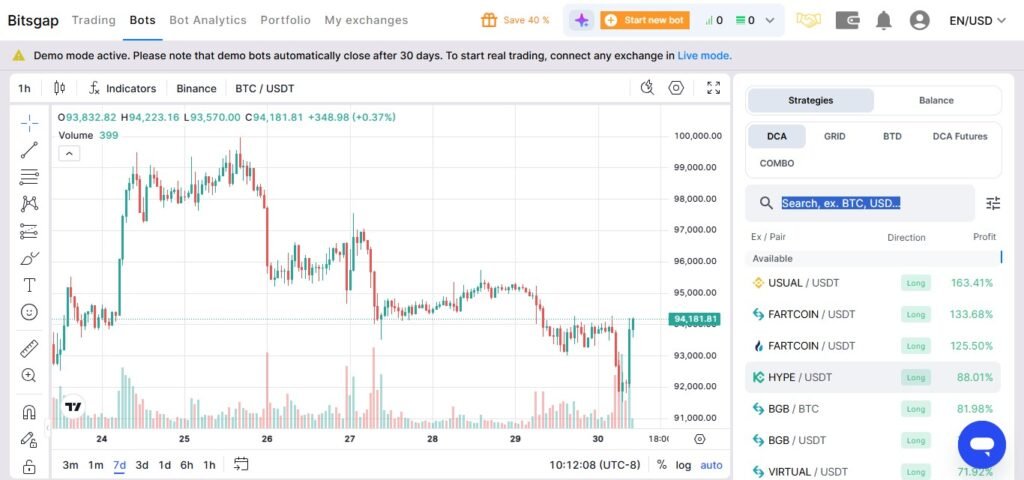

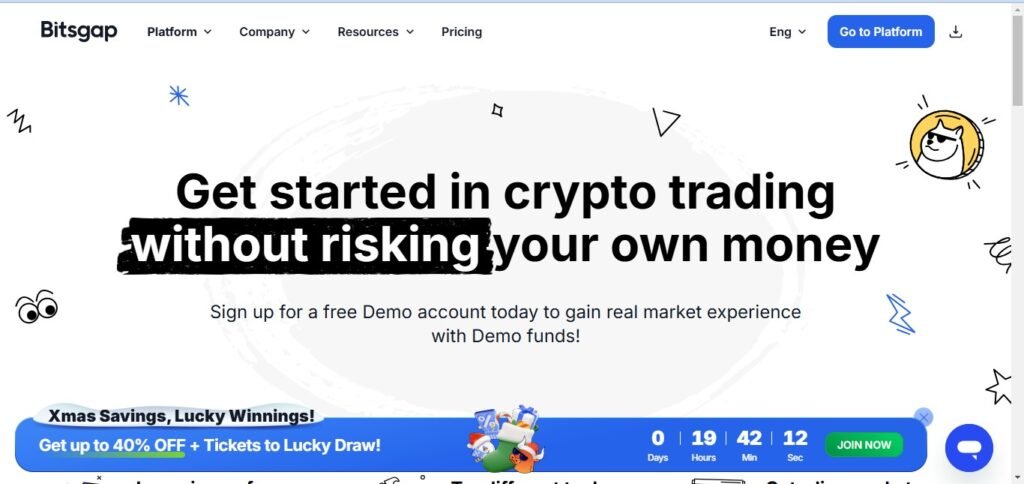

Using Demo Mode in Bitsgap

Before launching your first bot, I highly recommend using Demo Mode. To access it:

- Log in or sign up.

- Go to the profile icon and toggle on Demo Mode.

This mode allows you to use virtual funds and run demo bots. It’s important to test your setup before trading with real funds.

Launching a Bot

To launch a bot:

- Click on Start New Bot.

- Choose the Grid Bot (formerly known as E-spot).

This bot uses distribution logic to perform effectively in upward, downward, and sideways markets.

Bot Setup Process in Bitsgap

Selecting an Exchange

In Demo Mode, the exchange isn’t crucial since you’re trading with paper funds.

Choosing a Coin Pair

The pair field is where you select the coin pair (e.g., BTC/USDT).

- Base currency: Bitcoin (BTC).

- Quote currency: USDT (stablecoin).

Profits are generated in USDT by buying BTC when the price drops and selling it when the price rises.

Investment Amount

Set your investment amount, e.g., $1,000. This is the fund allocation for the bot to trade.

Manual Adjustment

Avoid using Quick Setup (short-term, mid-term, or long-term) and opt for Manual Adjustment for better understanding and control.

Defining the Grid Range

- High Price and Low Price define your grid range.

- Use tools like the Price Range Tool to measure and visualize your range on the chart.

Grid Levels

Grid levels determine the amount your bot trades at each line. For example, with a $1,000 investment and 10 grid levels, the bot will allocate $100 per level.

Grid Step Percentage

This percentage determines the price movement required to trigger trades.

- Larger steps: Less frequent trades, higher profit per trade.

- Smaller steps: More frequent trades, smaller profit per trade.

Key Features

- Autosized Currency: Leave as USDT.

- Trailing Up: Automatically adjusts the grid upward as the price increases.

- Pump Protection: Prevents trailing in the event of extreme price movements.

- Trailing Down: An advanced feature for experienced users to continue trading if the price falls below the grid.

- Stop Loss: Protects your capital by closing the bot if the price reaches a predefined level.

- Take Profit: Automatically closes the bot when a specified profit percentage is reached.

Backtesting

The backtest feature allows you to simulate performance over 3, 7, and 30 days, helping you refine your settings before launching the bot.

Launching and Managing the Bot

After finalizing the settings:

- Click Continue to preview the configuration.

- Start the bot, which will execute orders and appear on your dashboard.

Stopping the Bot

When stopping the bot, you have two options:

- Convert into USDT: Locks in profit or loss and converts funds back to USDT (recommended).

- Keep BTC and USDT: Retains both assets in your wallet for manual management.

Conclusion

I hope this tutorial helps you get started with Bitsgap bots. All the best with your trading endeavors!

FAQ

1. What is the purpose of this tutorial?

This tutorial is designed to help beginners understand the basics of Bitsgap, ensuring they can make money while avoiding unnecessary losses.

2. Which plan should I start with on Bitsgap?

It is recommended to start with the Advanced Plan because it includes the trailing up feature, which is essential for maximizing returns.

3. What is Demo Mode, and how do I use it?

Demo Mode allows you to use virtual funds to run demo bots before trading with real money. To activate Demo Mode:

- Log in or sign up.

- Go to the profile icon and toggle on Demo Mode.

4. How do I launch a bot?

To launch a bot:

- Click on Start New Bot.

- Choose the Grid Bot (formerly known as E-spot).

This bot uses distribution logic to perform well in upward, downward, and sideways markets.

5. What is the significance of the exchange in Demo Mode?

In Demo Mode, the exchange selection isn’t critical because you’re trading with paper funds.